The repurchase is also referred to as the “repo” and the agreement is for the sale of the security combined altogether to repurchase the similar security at a much high price at the future date and it is for short-term. The Repost agreement is generally used in establishing very short term transactions, usually with overnight terms although these can also extend for a period of years. For the short term repurchases, the risk factors are quite low and for long term repo, it faces the frequency of fluctuations in the market with high risk.

rbi.org

File Format federal funds repurchase agreement template" width="390" height="505" />

federal funds repurchase agreement template" width="390" height="505" />

newyorkfed.org

File Format

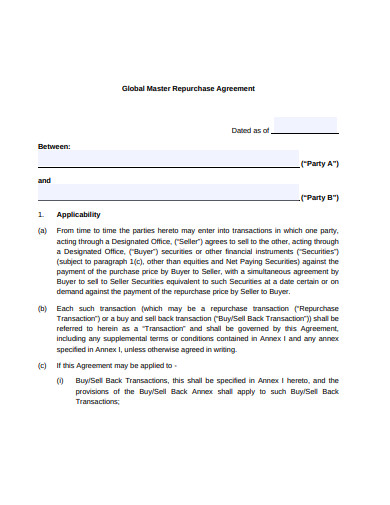

marquette.edu

File Format

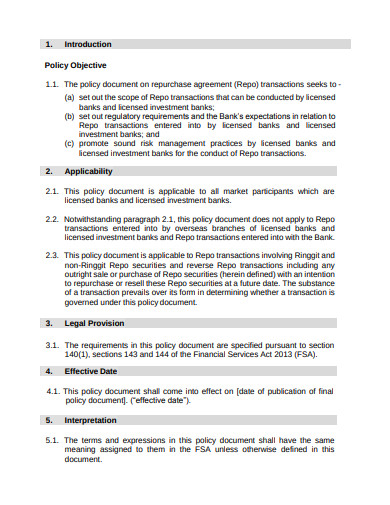

bnm.gov

File Format

richmondfed.org

File Format

ird.gov

File Format

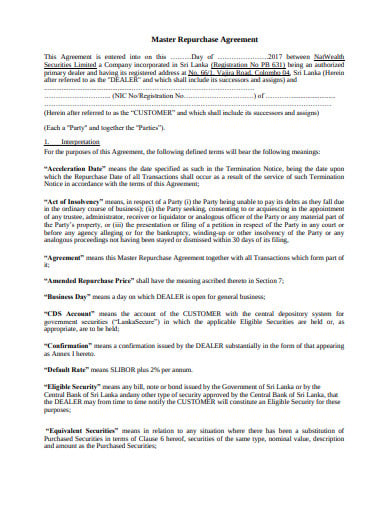

natwealth.com

File Format

schwabfunds.com

File Format

northerntrust.com

File Format

state.or.us

File FormatHow do the Repurchase Agreement Works?

When organizations require to increase immediate cash but do not need to sell off their long-term securities, and they shall simply enter into the repurchase agreement. And these agreements are common among the large banks and other large financial organizations, but it works on the small trade level as well. Therefore, the raising cash is not free of costs, and understanding your significant liabilities in a repurchase agreement will assist you to control the cost of keeping the extra cash on the balance sheet.

Step 1: Selling off the securities

You must think of the repurchase agreement as a loan with the securities as a guarantee. Here is an example such as the bank sells income to other banks and gives consent to buy the bonds back later on at a much high price. The business could include in the same activity by giving certificates of deposit, stocks, and bonds for sale to a financial organization and bank with the certain promise to purchase back the security in some future date for a much high price

Step 2: Purchasing back the securities

Under the repurchase agreement, the financial institution and the banks you sell the securities, bonds, etc to cannot sell them to anyone else until you default on the promises to purchase them again. And this means you shall honor the obligation to repurchase it. And when you failed to do so can hurt your credibility and accountability. It also can mean a lost chance if the investments would have raised up in value after your re-buying that.

Step 3: The Repurchase rate

You can usually come across the term “repo rate” while you’re discussing repurchase agreements. This term refers to a percentage you would pay to buy back the security investments. For example, you might have to pay a minimum percent higher rate at the time of repurchase. If you thought of this as interest, you might collate the advantages of the repurchase agreement against the price of borrowing the money form a bank.

Step 4: The Margin payment

One significant price for the repurchase agreement is margin payment. You have to build these when the price of the security investments drops prior to repurchasing it. The body holding the security can ask you to pay extra costs to make up for the decrease of value. For example, if the security investment is a bond and the market plans that the bond is no longer being valued of what it was when you made the repurchase agreement, you should make a margin payment to make up loss for the company you sold it to.

Step 5: Secured by Collaterals

In a repo, the investors and the lenders provide cash to the borrower, with the loan secured and protected by the collateral of the borrower, generally the bonds. In the event, the borrower defaults, the investor/lender receives the collateral and the securities. One particular party sells securities and borrows cash and promise to buy the security back in a future date.

Why does the Repurchase Agreement matters?

The Repurchase Agreement has developed into a very large part of the money markets, fueling the growth of short-term markets for mutual funds in dealing with the government-supported securities, like the T-bills. The agreement, or “repo,” market is an undiscovered but a significant portion of the financial system that has grabbed the increasing attention much lately.

The repurchase market permits the financial institutions such as the banks, which has lots of securities for e.g. banks, broker-dealers, hedge fund, etc so to borrow inexpensively and allows parties with lots of remaining cash like the money market, mutual funds to earn a small profit amount on that cash without much risk. The banks do not wish to hold the cash as it is expensive, therefore, it doesn’t pay much interest.

Here is an example, the hedge funds hold a lot of valuable assets but might require money to sponsor day-to-day businesses, so they can borrow from money market funds with plenty of cash, which can get a return without facing much risk. This repurchase repo is used to conduct monetary policies. When the parties purchase securities from the seller who consents to repurchase them, it is introducing reserves into the financial system.