An economic strategy that controls the volume and pace of expansion of the money supply in a country.

Hello, I'm Sethuraman from Munnar. I hold a B.com (Computer Applications) from PSG College of Arts and Science and am currently pursuing an MBA in Finance and Data Analytics at Kumaraguru College of Technology - Business School. Fluent in English and Tamil, I actively participated in university activities, including volunteering. I recently interned at "Wall Street Oasis," gaining practical exposure in finance, SEO, content writing, and research. Known for a positive attitude and sense of humor, I've set my sights on a challenging yet rewarding career in finance, driven by a strong sense of achievement and continuous self-improvement.

Reviewed By: Farooq Azam Khan

I am B.com+CMA(US), working as Business Analyst for WSO. Process Optimization, Financial Analysis, & Financial Modeling

Last Updated: June 22, 2024 In This ArticleMonetary policy is an economic strategy that controls the volume and pace of expansion of the money supply in a country. It is a potent instrument for controlling macroeconomic factors like unemployment and inflation.

Policies are carried out when Instruments are used, which include changing the amount of money in the economy , purchasing or selling government property, and changing interest rates. The central bank or a similar regulatory authority makes these rules.

The Federal Reserve Bank of the United States carries out a monetary policy under a twin mandate to maximize employment while containing inflation.

These policies regulate the total quantity of currency in a country and the channels or methods through which it is distributed.

Economic factors like inflation rate , gross domestic product , and sector- and industry-specific growth rates influence the monetary policy strategy. Adjusting interest rates is central banks' common tool to implement this policy.

Commercial banks face increased interest rates, making borrowing more expensive for businesses and individuals. This can lead to reduced borrowing and spending, which can help control inflation or stabilize an overheating economy.

Conversely, banks can pass lower rates to their clients when interest rates decrease, making borrowing more affordable. This promotes economic growth and investment.

The central bank also sets foreign exchange rates, purchases or sells government bonds , and adjusts the minimum amount of cash banks must hold in reserves.

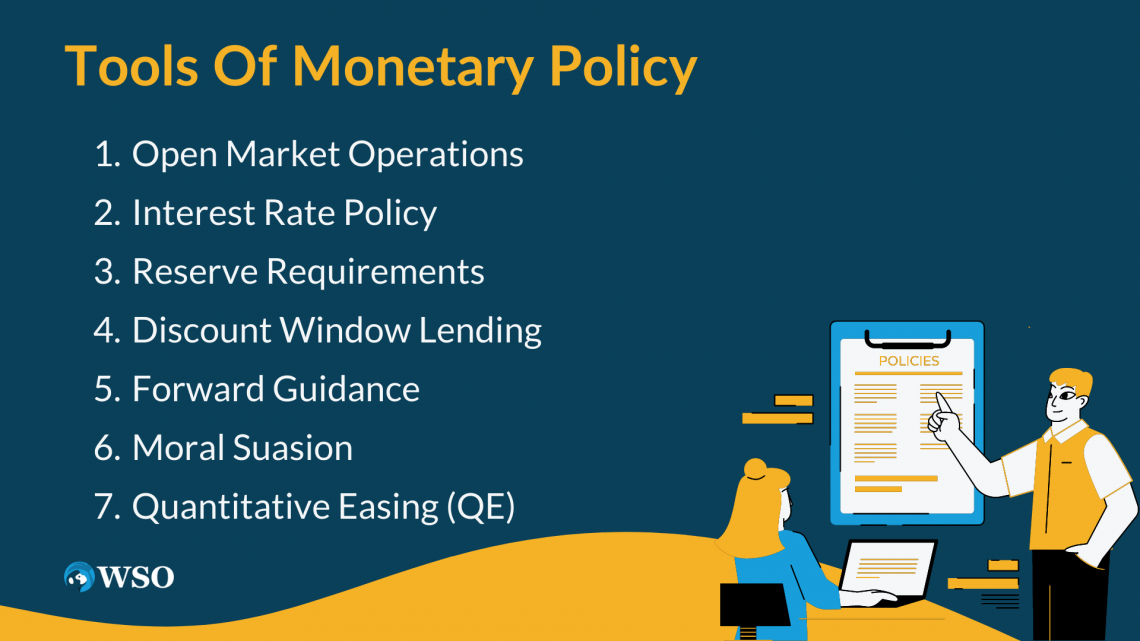

Central banks employ various tools to actively manage monetary policy and influence the money supply, interest rates, and broader economic conditions .

These tools shape and steer these variables to achieve desired economic outcomes and maintain financial stability.

The major tools used can vary depending on the central bank and the prevailing economic circumstances. Here are some common monetary policy tools:

The central bank buys and sells government securities (bonds) in the open market .

Conversely, when it sells securities, it reduces the money supply. Open market operations are primarily used to control short-term interest rates and manage liquidity in the banking system.

Buying or selling securities is an Open market operations is primarily used to control short-term interest rates and manage liquidity in the banking system.

Selling securities helps manage excess liquidity and prevent potential inflationary pressures.