For some reason, this guy you just met at a party has suddenly taken a liking to you. To him, you seem sharp and able to recognize a gold mine when you see it. He only offers this tip to his closest friends, but he's willing to make an exception for you. He says if you get in on this opportunity now, you'll be an early investor in the next big thing. Not only that, it's fail-safe and will return your investment in no time. If you're skeptical, why not ask your friends at the party -- they invested last month and have already seen returns. You do ask them, and it's true. So why not hand over a few thousand dollars before it's too late? Despite what your trustworthy friends say, it's better to walk away. This guy is probably selling a Ponzi scheme.

Unfortunately, not all financial schemes look the same, which makes it hard to spot one when you're victimized. In true Darwinian style, clever scammers are able to thrive by consistently adapting and evolving their schemes to come up with new ways to con others out of their life savings. The Ponzi scheme is just one type of con. And, although it's based on a classic formula, the idea can be applied in countless ways to deceive unsuspecting victims.

Ponzi schemes pop up frequently, though not all of them are big enough to make headlines. But every few years, a news story comes out telling how authorities have exposed an extensive and long-running Ponzi scheme. Two such exposed schemes (one that broke in 2006 and the other in 2008) were each reportedly bigger than any before them. Bernard Madoff, who orchestrated the most massive Ponzi scheme to date, conned about $65 billion from investors who came from all walks of life.

Why is the scheme so effective? And how is it that your victimized friends in the earlier example actually did make some money? We'll examine the formula behind a Ponzi scheme as well as the recent instances that have popped up in the news. But first, let's take a look at Charles Ponzi, the notorious schemer whose name became so synonymous with the scam that it now bears his name.

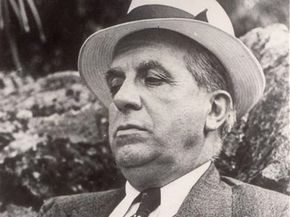

Charles Ponzi's Scheme

In the 1920s, whenever a generous person wanted to send a piece of mail overseas, he or she would probably also buy an international reply coupon. This was handy for the recipient because it was a voucher that paid for the postage required to reply back to the sender. Because this was a relatively common system at the time, no one questioned Charles Ponzi (an Italian immigrant to the United States) when he found an intriguing investment opportunity in the process.

Ponzi's investment idea was plausible: He could buy reply coupons in a different country where they were cheaper, and then sell them in the United States where they were worth more [source: Trex]. The difference was profit that he could share with his investors. He sucked his investors in by promising 50 percent returns in 45 to 90 days [source: Valentine].

The hitch? When he tried to carry through on his business idea, it didn't work out as well in practice as it did in theory. The mechanics of conducting business overseas, transporting the coupons and exchanging them for cash caused delays and extra costs that prevented him from paying investors as quickly as he'd promised. Nevertheless, he kept the bad news to himself. Every day, new, excited investors who heard about the idea wanted in and handed over their savings. Ponzi decided to take the money, but not run. He kept up the ruse by paying off his initial investors with some of the new money that was pouring in and pocketed some for himself. Because his early investors were making money, no one was complaining.

He wasn't clever enough, though. The whole thing fell apart after a few months of Ponzi living lavishly on the millions he had made. People starting wondering how he was buying and selling what must've been 160 million reply coupons out of the 27,000 that existed in the world [source: Trex]. Eventually, authorities busted him.

Charles Ponzi wasn't the first to implement such a scam. However, he stood out from the rest of the petty crooks because of the amount of money he raked in -- which totaled millions of dollars -- and number of people he swindled.

Ponzi Scheme Basics

Though it landed him in jail, Charles Ponzi's infamous scam spawned many imitators. The get-rich-quick scheme has proved too alluring for other scoundrels to pass up. However, these imitators need not use the front of international reply coupons to make it work.

The basic framework of a Ponzi scheme can be applied and reapplied in countless contexts. The scheme revolves around the process of paying old investors with the money you get from new investors. The central method remains the same. All one has to do is hook a few investors who are willing to get in early on a once-in-a-lifetime business venture. The details of the investment don't matter too much. What suckers people in is the promise of fantastic returns on investments.

After the schemer has convinced a handful of investors to fork over money, those funds can bankroll a nice car -- or, if the schemer is truly sneaky, he or she can use it to rent office space and buy some fancy furniture. These props will help con the next round of investors. Now, he or she is ready to find more investors. This time, the schemer takes a slice off the top for himself or herself and uses the rest to pay off the first rung of investors with some initial returns. (Some liken this to robbing Peter to pay Paul, but it's not quite the same, as we'll see.)

Eventually, the second rung of investors will need its payout. This is a simple matter of wash, rinse and repeat: The money from a newly recruited third rung of investors can pay off the second rung and deliver more returns to the first rung.

But as the cycle goes on, it gets more complicated. Earlier rungs of investors will get suspicious if they don't continue to see returns. New investors will have to be paid back their initial investment, and the schemer will have to appease them with regular returns. This means that new investors will have to be added to the Ponzi scheme continuously in order to pay all the previous rungs. The schemer is under an enormous amount of pressure to keep adding investors, and one person can only do so much. (This is why the most successful schemes typically involve accomplices, but this merely delays the inevitable.) The scheme will eventually become unsustainable. The upside-down house of cards the schemer has built will finally collapse.

Ponzi Schemes vs. Pyramid Schemes

Many people associate Ponzi schemes with pyramid schemes. While they do share some similarities, they're not exactly the same. If you think about the organization and methodology behind a Ponzi scheme, it certainly has a triangular structure. The schemer sits at the top, above continually increasing rungs of investors. However, there are fundamental differences between how classic pyramid schemes are carried out and how Ponzi schemes are executed.

The essential difference between a pyramid scheme and a Ponzi scheme is that a Ponzi schemer will only ask you to invest in something. You won't be asked to take any more action than handing over money. He or she will claim to take care of the rest and give you your returns later. The Ponzi schemer is the mastermind behind the whole system and is always shuffling money from one place to another.

On the other hand, a pyramid schemer will offer you an opportunity to make the money yourself. It requires more work, though: You have to buy the right to start a franchise and start recruiting more people like yourself. The recruits will often pay the recruiter a cut of their profits. You can read How Pyramid Schemes Work to understand more about that process.

The difference may seem slight, but one point to keep in mind is that unlike pyramid schemes, Ponzi schemes are always illegal [source: Walsh]. Some legitimate businesses, such as Mary Kay and The Pampered Chef, have been built around the pyramid idea. But the nature of a Ponzi scheme necessarily relies on securities fraud. It involves deceit to convince someone to invest money that won't actually be invested.

Nevertheless, some people continue to use the terms interchangeably, and many texts classify Ponzi schemes as a type of pyramid scheme. And, of course, when you're the victim of one, the difference probably seems insignificant.

Lucky VictimsSome victims make out pretty well in a Ponzi scheme. Although later investors certainly lose money, the early investors can come out ahead. Their testimonials are exactly what help perpetuate the scheme. Some unscrupulous characters invest with the full knowledge that they're funding a Ponzi scheme -- they cross their fingers that they aren't in the bottom rung. Of course, any money they make is at the expense of other investors. Legal questions abound as to whether these lucky initial investors should be forced to help recoup losses for later investors [source: Berenson].

Other Notable Ponzi Schemes

As we mentioned earlier, Charles Ponzi didn't invent the scheme himself. Ponzi's biographer, Mitchell Zuckoff, writes of his predecessors, Sarah Howe and William Franklin Miller. In 1880s Boston, Sarah Howe offered female investors a chance to make money in the Ladies Deposit. She garnered half a million dollars from more than a thousand women, using some of the funds to pay off other investors and pocketing the rest. A couple of decades later, William Franklin Miller came along and tried the scheme again to even bigger success. He promised unheard-of returns, and when he came through on his promises, more investors poured in, handing over a million dollars in total before he was exposed [source: Zuckoff]. In Miller's case, the victims were so thrilled by the success of their investments that they chose to reinvest their earnings in his scheme [source: Zuckoff].

Clearly, Ponzi wasn't the first to implement the scheme, and he wasn't the last -- not by a long shot. Since his stunt in 1920, many Ponzi schemes have been exposed around the world. Some in the past few decades have been the most damaging, however. In Albania in 1996 and '97, several schemes using the Ponzi method swindled a total of $2 billion from the public (the amount equaled about 30 percent of the country's gross domestic product) [source: Shiller]. Once the scheme was exposed, riots broke out, causing several deaths.

Until late 2008, the reigning champion of Ponzi schemers was Lou Pearlman. Remember the boy band craze that started the late 1990s? The bands Backstreet Boys and 'N Sync were two of the most popular musical groups of the period, and each was created and financially backed by Pearlman. By 2006, authorities found out that he'd been orchestrating an enormous, long-running Ponzi scheme, which helped him initially fund the bands. For a good 20 years, he had convinced others to invest in nonexistent companies for which he claimed to have FDIC and AIG insurance.

Pearlman received a jail sentence of 25 years for conning $300 million from investors. For every million he paid back, a month was cut off of his sentence [source: Sisario]. If you think that's a lot of money, brace yourself for Bernie Madoff.

Bernard Madoff's and Allen Stanford's Ponzi Schemes

In December 2008, Bernard Madoff revealed that the asset management arm of his firm, Bernard L. Madoff Investment Securities, was "just one big lie" [source: Henriques]. In what he described as a Ponzi scheme, it's estimated he took his investors for a cool $65 billion over the course of nearly two decades. And he didn't just con fat-cat billionaires and celebrities (such as Zsa Zsa Gabor, Kevin Bacon and Steven Spielberg); humbler individual investors, banks and even charities lost money in the scheme [source: WSJ, Sunday Times]. The scheme wasn't revealed until Madoff himself confessed his crimes. In March 2009, Madoff pled guilty to the charges against him, and he was sentenced to 150 years in prison the following June [source: Edwards].

One reason that Madoff was so successful was that he was a highly respected, well-established and esteemed financial expert -- his reputation was bolstered by the fact that he helped found the NASDAQ stock exchange and served a term as its chair. What's more, at the same time he was running his scheme, he was also running a legitimate business [source: Appelbaum]. He earned his investors' trust because whenever they requested a withdrawal, Madoff's investment company got their money to them promptly. In addition, unlike other Ponzi schemers, he didn't tempt investors with unbelievable returns. He reported moderate (albeit, suspiciously consistent) returns to his investors.

It's not unusual for tip-offs such as these to help authorities build a case and eventually expose a Ponzi scheme [source: Scannell]. However, in the Madoff case, the Securities and Exchange Commission (SEC) failed to come up with any smoking gun, which might've been as straightforward as making Madoff provide proof of his holdings [source: Appelbaum]. According to some sources, any examinations the SEC conducted fell drastically short [source: Moyer]. Madoff himself later said he was "astonished" that the SEC failed to catch him [source: Katz].

While investors were still reeling from the fallout from the Madoff case, another Ponzi scheme led by Texas billionaire banker Allen Stanford was broken. Like Madoff's scheme, Stanford's dwarfed most other Ponzi schemes; he managed to accumulate $8 billion over a decade from the sale of fraudulent certificates of deposit (CDs) in his bank in Antigua [source: Creswell and Krauss]. Unlike Madoff, however, Stanford attracted investors through interest rates that were too good to be true. Also unlike Madoff, Stanford's cohorts in the scheme -- all officers in his bank -- were also indicted.

In the wake of the Madoff and Stanford Ponzi schemes, the SEC has stepped up investment regulation and fraud detection measures. It's unlikely that it will be able to rid the world of Ponzi schemes entirely. So if Ponzi schemes still abound, you should know what to look for.