A commercial invoice is a billing document that is sent alongside internationally shipped goods. It is a contract that is entered into by a seller and buyer of physical goods and is used by customs agencies to determine the amount of tax that should be charged. It clearly outlines what is being shipped, the parties involved (recipient and deliverer), where it is going, and how much the customer is required to pay for the goods, among other pertinent information.

Proforma Invoice Template – The “Pro” in “Proforma” refers to the fact that is an invoice delivered to a client prior to a transaction being finalized. It lists the included items and total value of a shipment prior to reaching the customer.

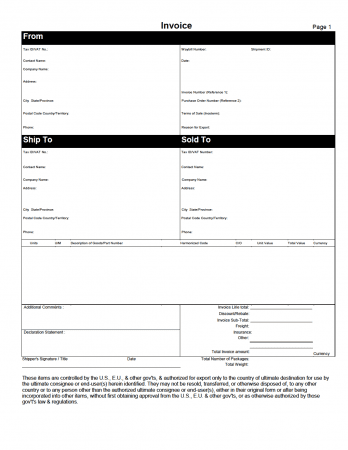

Blank Commercial Invoice – A general-use commercial invoice that can be customized to meet the needs of the company shipping the goods. For making changes to the document, the Word (.docx) version is recommended.

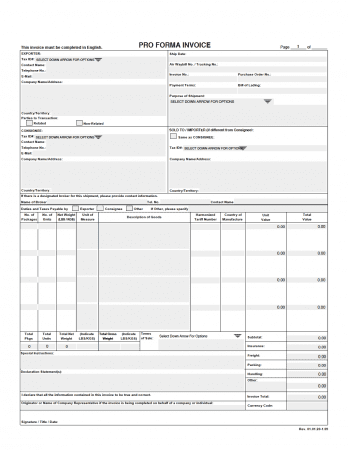

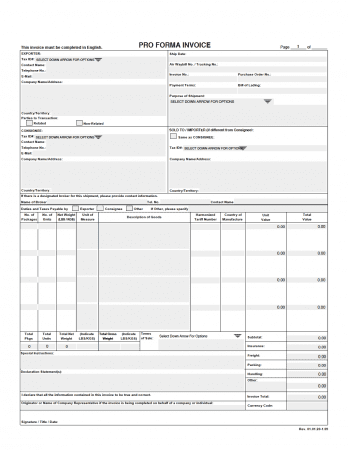

FedEx Proforma Invoice – A two (2) page document used by sellers for shipping with Federal Express (known as “FedEx”). The form needs to be completed, printed out, and inserted with all shipped packages.

UPS Commercial Invoice – Must be included in each every shipped package that is heading out of the United States. Used for shipping with UPS only.

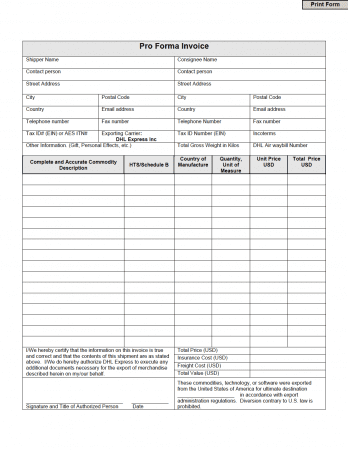

DHL Proforma Invoice – Contains information on the parties, the contents of the package(s), their value (for taxes), where the product(s) were manufactured, their weight (in Kilos), Tax #’s, and more. For use with DHL only.

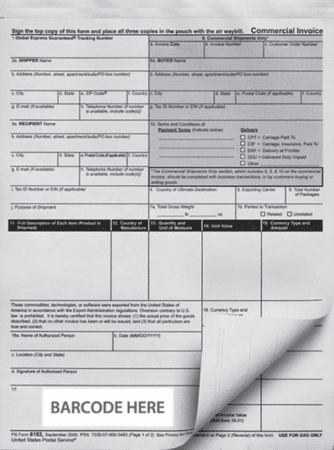

USPS Commercial Invoice – The form can no longer be downloaded from the internet, as each form has to have a unique barcode provided by USPS. The forms can be found at the USPS Postal Store.

Step 1 – Download

The shipper will need to download the invoice template in PDF or Word. If the shipper intends to complete the form by-hand and they have a large order, it’s recommended that they print out one (1) form, complete it, and then scan it so they can print out multiple times. This saves them from having to re-write the document multiple times.

Step 2 – Shipper / Exporter

Enter the name of the company shipping the goods.

Step 3 – Consignee

The name of the person or entity receiving the goods is entered into this section.

Step 4 – Notify Party / Intermediate Consignee

A secondary party other than the entity receiving the goods. Typically has interest in the goods getting to their final destination. It can be a person acting as an agent in a foreign country. Not a required field.

Step 5 – Date

Enter the date in which the invoice was completed.

Step 6 – Commercial Invoice No (#)

A string of letters and/or numbers used for identifying the goods. It can be set by the seller for their own accounting purposes.

Step 7 – Customer P.O Number

A number issued by the buyer for their own internal organization. Will be referenced throughout the shipping process.

Step 8 – Date of Export

The date the goods were officially shipped.

Step 9 – Country of Origin

The country where the package was originally sent from.

Step 10 – B/L / AWB Number

B/L refers to “Bill of Lading”, which is a receipt of the contract formed between a freight carrier and shipper. The document must be attached to the shipment (if required). An AWB number, known as “Air Waybill”, is a tracking number issued by FedEx.

Step 11 – Final Destination

The country in which the package(s) are destined.

Step 12 – Export Route / Carrier

The shipping company (or route) that are transporting the goods.

Step 13 – Terms of Sale

The applicable “Incoterm” should be entered in this field. See below.

Step 14 – Terms of Payment

How the buyer will go about paying the seller for the goods. This is agreed upon prior to shipping the products.

Step 15 – Prepaid vs. Collect

If the seller is responsible for paying for the shipping, check “Prepaid”. If the buyer is responsible, check “Collect”.

Step 16 – Marks

Information that identifies the cargo.

Step 17 – Quantity

The quantity of each item included in the shipment should be written next to each product type.

Step 18 – H.S Number

Known as the “Harmonized Commodity Description and Coding System (HS)”, it’s a code that is attributed to each type of good. Codes can be looked-up here.

Step 19 – Unit Price

The cost of one (1) product. For example, if the product is computers, it would be the cost of a single computer.

Step 20 – Total Price

The quantity multiplied by the unit price.

Step 21 – Subtotal

Calculated by summing (adding up) the “Total Price” column.

Step 22 – Handling

The cost of shipping the goods. This field is typically used for smaller orders.

Step 23 – Freight

Like “Handling”, is also the cost of shipping the goods, but is typically used for larger shipments.

Step 24 – Misc.

Any other costs that should be included in the total invoice amount.

Step 25 – Total

Calculated by summing the “Subtotal”, “Handling”, “Freight”, and “Misc” fields.

Step 26 – Signature(s)

The shipper will need to sign the invoice in the provided space at the bottom of the page. They should also print their name for clarity. Additionally, the country in which the goods are destined should be written in the field at the very bottom of the document.

The Incoterms are international terms used for reducing communication regarding shipped goods. It defines the transaction between the importer and exporter. The following are the codes, updated 2020. As of now, there are no new Incoterms for 2021.